Business Exit Planning

Expert Legal Support for Seamless Business Transitions.

Protect the Value and Legacy of Your Business

Developing Your Business Exit Plan

Developing Your Business Exit Plan An exit plan is a strategic approach to selling or transferring business ownership. A well-designed plan creates a clear roadmap for partners, shareholders, heirs, and successors to follow in the event of your death, incapacity, or retirement. Common exit strategies include mergers and acquisitions (M&A), management buyouts (MBOs), and family succession. Each strategy has its pros and cons, and the choice depends on factors such as the entrepreneur’s goals, the business’s financial condition, and market conditions. A clear exit strategy can enhance a startup’s attractiveness to investors and ensure a smooth transition when the time is right.

The Importance of a Business Exit Plan

Business exit planning is more than just distributing assets after death; it is crucial for ensuring that your business continues to thrive in your absence. This process is essential for long-term continuity and involves identifying and developing future leaders.

This helps to prevent conflicts or disruptions when key employees leave or retire.

An effective exit plan should establish clear objectives, assess available resources, and create a management succession plan that aligns with your estate planning. By following these guidelines, you can facilitate a smooth transition and protect your business's value and legacy.

Optimizing Your Tax Strategy

Understanding the tax implications of your business is essential for effective income and estate planning during the Business Exit Planning process. Income and estate taxes associated with business ownership can create significant burdens for your company and your family, particularly if proper precautions are not taken. With some exceptions, estate taxes must be paid within nine months of a person’s death, so understanding and preparing for the potential tax implications of your business is critical. Our firm can assist you in minimizing income and transfer taxes (asset protection) through creative structuring techniques.

Business Exit Planning Resources

Business Exit Planning FAQ’s

-

Watch the Video or Read the Blog

LOI (Letters of Intent) generally include non-binding provisions for the proposed structure of the purchase or sale, the due diligence that will be conducted, the representations and warranties (reps & warranties). It also includes binding provisions such as confidentiality and non solicitation agreements as well as an exclusivity period.

-

Watch the Video or Read the Blog

Retention bonuses protect the Seller, Key Employees and Buyer. The Seller - by keeping key employees incentivized to help the company achieve agreed upon targets after the sale. Sellers may have additional payouts that are “earned” (earnout) after the sale. The Key employee - by providing job security and incentives. The Buyer - by keeping the intellectual capital (key employee knowledge) with the company for a while after sale.

-

Watch the Video or Read the Blog

A family holding company is an LLC (limited partnership): Instead of transferring an asset directly into the hands of the next generation, this combines family-owned assets into a family holding company and use it as a centralized way of managing the family’s wealth. This ensures assets can be controlled by you, but shifted out of your estate and to your future generations or trusts for their benefit.

-

Watch the Video or Read the Blog

A Management Succession Plan (MSP) is a vital component of your Business Success(ion)™ plan (Business Exit Strategy). A Management Succession Plan (MSP) determines who will run your business if you face an unexpected exit, either by death or incapacity.

-

Watch the Video or Read the Blog

Passing on your business to the next generation by creating management (how your business will be managed if you are gone) and business succession plans (how your business will be owned) will help you get the most value for your business and hopefully, avoid hurting family and business partners.

Business Exit Planning: The Book

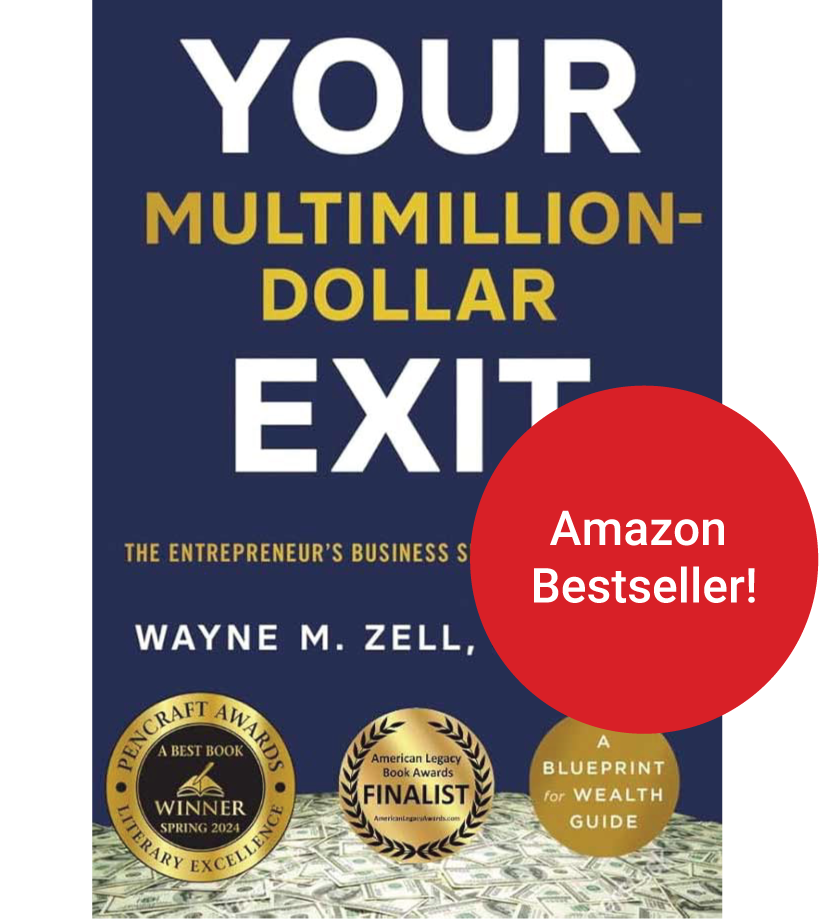

“Your Multimillion-Dollar Exit”

A comprehensive legal and business guide designed for entrepreneurs planning to sell or transfer their businesses. Wayne Zell, a certified exit planner (CExP) and firm leader, has facilitated hundreds of transactions, helping clients earn millions and maximize savings through effective tax planning strategies.

“...a must-read. I wouldn’t have been able to position my business for a successful sale without Wayne’s knowledge, multidisciplinary experience, and practical advice.”

David Eisner, Founder, former CEO and Chairman, Dataprise, Inc.

Read the Great Reviews

Design Your Exit Strategy from Day One. Amazon Best Seller. Winner of 5 Prestigious Book Awards.